CS International champions a green agenda

Richard Stevenson, CS International Conference Programme Manager and CS Magazine Editor reflects on the April 2024 event.

Tackling climate change understandably gets less media attention these days, with the focus shifting to the coverage horrendous conflicts around the globe. But the need to cut carbon footprints and get a grip on global warming is still of vital important – and got the justifiable prominence it deserves at this year’s CS International.

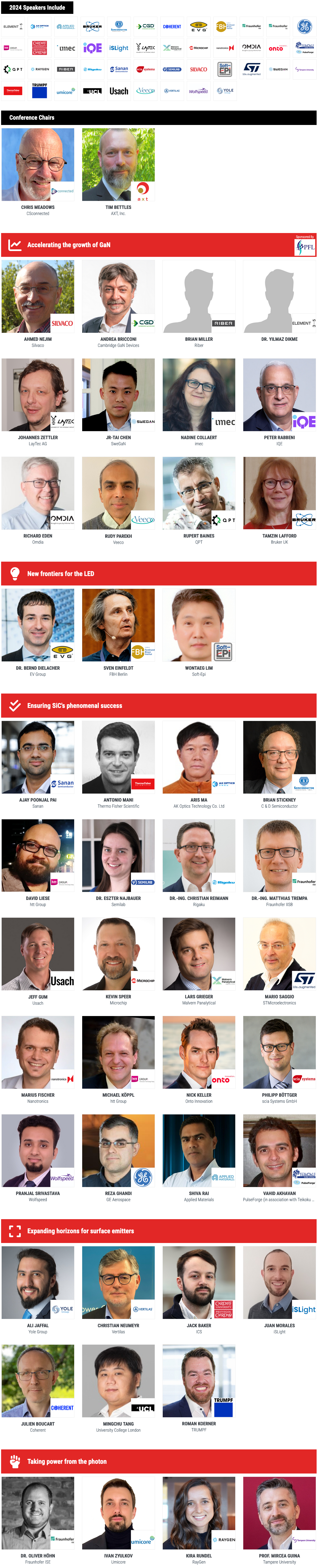

At this conference, held in Brussels on 16 and 17 April, many speakers detailed efforts to streamline the production and increase the volume of energy-efficient wide bandgap devices, while others outlined how optoelectronic devices can play their part in tackling climate change.

Significant progress in cutting emissions can come from increasing the electrification of our world, greater adoption of renewable forms of generation, and improving electrical efficiency. Around half of the world’s electrical energy is used to drive motors, a proportion that’s only going to increase. Here there is a tremendous opportunity to boost efficiency, according to the International Energy Authority: this body claims that if energy is used more effectively in motors, around 25 percent of global electricity use could be saved, a goal that would be helped through increased adoption of devices with a wider bandgap.

Assisting in this endeavour is the ramp in worldwide production of SiC and GaN power devices, a trend that will continue, thanks to efforts by many manufacturers to increase their capacity. These chipmakers include STMicrolectronics, which has plans for expansion that were outlined at CS International by Mario Saggio, Company Fellow and R&D Design Director.

Saggio extolled the “outstanding characteristics” of SiC, arguing that while this class of device costs more than silicon rivals, it still delivers savings at the application level.

ST is a well-established player in the SiC industry. It started investing in SiC more than 25 years ago, and last year sales of its SiC devices generated $1.14 billion. The company dominates the SiC MOSFET market, with a share of more than 50 percent, according to Saggio.

This global player in the power industry has an incredible degree of vertical integration, stretching from raw materials to the design and manufacture of SiC products. It has a SiC substrate plant in Norrköping, Sweden, which manufactures 150 mm substrates and produces 200 mm variants with industrial quality and yield; and a new integrated plant in Catania, Italy, that produces devices from 150 mm substrates. Pilot production started this year at the facility in Catania, and big plans for this plant include volume production in 2024, the migration to manufacture on 200 mm wafers, and the addition of 700 staff.

ST continues to evolve its SiC planar MOSFET technology. Second-generation devices were launched in 2017, followed by third and fourth generations that have benefitted from a reduced JFET and improved epitaxy, followed by an optimised edge alongside additional improvements to epitaxy. ST’s fifth generation of SiC MOSFET, now in development, will benefit from reduced contact dimensions.

Comparing the second generation of MOSFET to that in development, specific on-resistance for the 650 V and 1200 V variants are lower by almost 40 percent and 50 percent, respectively. Additional improvements, supporting further energy savings, may come from the introduction of a superjunction design, which Saggio said is under consideration.

Another company with big plans for SiC is Sanan Semiconductor, which is better known as the biggest producer of LED chips and epitaxial wafers in China.

Speaking on behalf of this company, Ajay Poonjal Pai, Director of Wide Bandag Innovation and Applications Engineering, told delegates that Sanan started developing SiC technology in 2014, and has become China’s first vertically integrated manufacturer of these devices. The company has control of the complete supply chain, from SiC crystal growth to the packaging of power devices.

Backed by $2.3 billion of investment, Sanan is building what Pai describes as a state-of-the-art mega-fab. It’s first phase is now complete, enabling a ramp in production to 200,000 wafers per year. Following further work, capacity is expected to increase to 500,000 wafers per annum. Current production is on 150 mm SiC, but the company will switch to 200 mm wafers by the end of this year.

Sanan entered the SiC power device market with the diodes, and shipped more than 100 million in 2022. Based on its third generation of diode, the company has recently released a fourth generation that majors on a low forward voltage, and a fifth that boasts high surge-current capability.

Later this year Sanan will launch its first range of SiC MOSFETs. This automotive-qualified product portfolio will offer blocking voltages of 650 V, 1200 V and 1700 V.

Another champion of SiC is Wolfspeed. Speaking on its behalf at CS International, Pranjal Srivastava, who is responsible for strategic business development at the global level, detailed benefits realised by using SiC devices, rather than those made from silicon, in 25 kW three-phase motor drives.

This opportunity, which offers “immense market potential”, can trim losses by up to 50 percent.

To arrive at that figure, Srivastava and colleagues compared the efficiency of power-factor-correction units with a silicon IGBT design, operating at 20 kHz and having a power density of 3.5 kW/litre, with a design using SiC MOSFETs operating at 45 kHz and providing a power density of more than 4.6 kW/litre. The unit using devices with a wider bandgap enables an increase in peak efficiency from 97.2 percent to 98.5 percent. In addition, the team have considered gains in the performance of an inverter, with SiC providing a 1.1 percent improvement in efficiency.

Taken together, the efficiency gains total 2.4 percent, equating to 600 watts. Srivastava has calculated that this enables a financial saving of more than €7,000, based on today’s electricity costs in Germany and assuming that this motor runs almost continuously for 15 years.